Winter 2026 — Market Statistics

How Are Increases in Insurance Premiums Affecting Housing Costs in Washington?

There have been reports in the national press recently about high rates of growth in insurance premiums for single-family homes in some parts of the country. In part, these premium increases reflect the repricing of reinsurance purchased by insurance companies to protect against catastrophic losses. Increasing climate-related hazards, such as hailstorms in the Midwest or hurricanes in Louisiana or Florida, are an important component of the increase in reinsurance costs. Growth in construction costs is also affecting insurance premiums. Nationally, home hazard insurance premiums increased 58% between 2018 and 2024. In some locations, premiums have increased at a much faster rate, to the point that they are having significant negative effects on house prices.

What has been happening in Washington state?

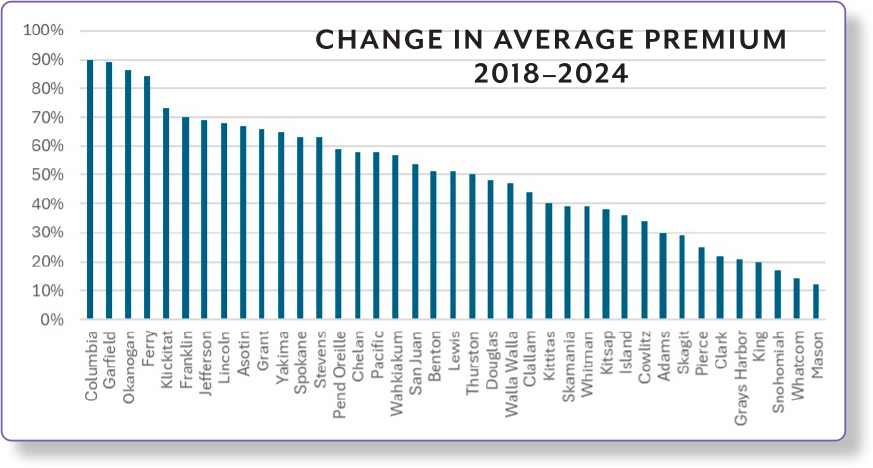

Using a national database of escrow payments, researchers have, for the first time, been able to provide a detailed analysis of trends in average insurance premiums at the county level for most counties in the country. In Washington state, the rate of growth in insurance premiums between 2018 and 2024 has varied across counties, as shown in the chart above. The growth rate ranged from a high of 90% in Columbia County to a low of 12% in Mason County. Counties with larger populations had lower growth rates, meaning that the overall weighted average for the state was around 33%, or well below the average for the nation.

In fact, the average cost of hazard insurance in the state as a percentage of the median house price decreased slightly between 2018 and 2024, from 0.4% to 0.3%. In 2024, the lowest average premiums as a percentage of property value were in King and Snohomish counties (both 0.2%). The highest average premiums as a percentage of median house value were in Garfield, Ferry, and Lincoln counties (1.0%, 0.9%, and 0.9%, respectively). This pattern largely reflects the fact that land value makes up a higher percentage of property value in more urbanized areas, and land is not insured.

While increasing wildfire risk is affecting the cost and availability of hazard insurance in some parts of the state, Washington has generally not experienced the large average increases in premiums that have occurred in other parts of the country. Although premium increases vary widely across counties in Washington, average premiums as a percentage of house value are within a fairly narrow range. If calculated as a percentage of structure value (exclusive of land), the range would be even narrower.

The statistics reported here are based in part on data collected for a working paper published recently by the National Bureau of Economic Research by Benjamin Keys and Philip Mulder, titled “Property Insurance and Disaster Risk: New Evidence from Mortgage Escrow Data”.

Steven C. Bourassa, Ph.D.

Director of the Washington Center for Real Estate Research

Runstad Department of Real Estate

University of Washington | wcrer@uw.edu

RE Magazine Winter 2026 Issue

Quick Links to Articles

- Presidents' Message

- Market Statistics — Changes in Insurance Premiums Affecting Housing

- WASHINGTON REALTOR® Profile: Steve Chung

- Why Hill Day Matters — A Conversation with James Fisher

- 2026 Washington State Legislative Session

- REALTORS® + Housing Program Expanding in 2026

- RPAC Did That For Homebuyers & Sellers!

- The Last Print Edition of RE Magazine

- Enhancing the Value of Your Membership